How to Pay Your Credit Card Bill Using Another Credit Card?

Paying card bills can sometimes pose a challenge, especially if you are using multiple credit cards. Accumulating huge debt on a single card can also be difficult to repay. So, you may seek to pay the bill with another card. For that, knowing how to pay other credit card bills with an infrequently used credit card is essential.

It is important to keep in mind that:

-

This payment strategy only adds to your debt, so have a repayment plan in place

-

Most card issuers or banks do not allow you to directly pay one card’s bill with another card

-

There are indirect ways in which you can pay your bill using a different card, such as:

-

By using a credit card balance transfer facility

-

By using digital wallets

-

By paying through cash

Continue reading to understand every process in detail.

Process To Pay Credit Card Bill Using Another Card

-

Balance Transfer Facility

Certain credit cards allow you to transfer your balance from another card to it and give you a low interest rate and a specific tenure to repay. While this can be a cost-effective strategy to handle your bills, the actual charges vary depending on which card you transfer the debt to.

Before taking such a decision, keep these things in mind:

-

Transferring the balance from your credit card to another card will involve fees and charges as well as a strict timeline.

-

Ensure that the card you are choosing has a lower interest rate.

-

If you fail to make the payment on time, you will be charged interest on the outstanding balance even during the interest-free period.

-

A credit card balance transfer may have an impact on your credit score.

-

Check the credit utilisation ratio of the card to which you plan to transfer the balance.

You should evaluate the expense against the benefits to determine whether a balance transfer is the best option for you.

-

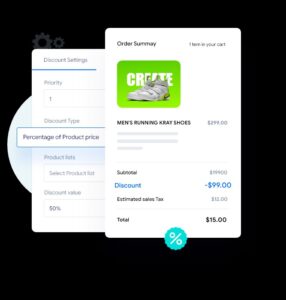

Digital Wallet

The use of digital wallets in India has increased significantly since they give a rapid and convenient option to make payments. Using mobile wallets is another way to pay your credit card bill with a different credit card:

-

First, check the minimum due amount in credit card bill as well as the total dues.

-

Then, transfer the required amount of funds from a different credit card to the digital wallet.

-

Use the wallet’s balance to pay off your credit card bill.

-

Payment Through Cash

If you think credit card balance transfer and digital wallet are not a good option, then you can also go for cash payment. To do these, follow the below-mentioned steps:

-

Using your other credit card, withdraw the necessary amount from the ATM.

-

Then, deposit the cash into the account from which you will pay the first credit card bill.

-

Pay off your first card’s debt easily with this amount and repay the debt on the other card at your own pace.

-

Just keep in mind that some credit card issuers charge high interest on ATM withdrawals.

Negative Of Paying One Credit Card’s Bill With Another

While paying a credit card bill with a different credit card appears to be convenient, make sure that you analyse the disadvantages of each strategy. These include:

-

Additional Fees

When you pay with a different card, you have to pay a balance transfer processing fee. This may come to 2% of the total transaction amount.

-

Excessive Interest

Cash withdrawals come with higher-than-normal interest rates and may involve processing charges too. So, check to see if your card allows you to withdraw from an ATM at no cost for a certain tenure.

-

Debt Cycle

If you are not careful to repay your bills you can end up in a debt trap that isn’t easy to get out of. This can impact your financial health in the future.

-

Negative Effects On Your Credit Score

Missed payments, late payments, and high unpaid dues can lower your credit score.

Although it may appear doable, this should not become a habit. Paying with another card might lead to debt accumulation with huge interest rates. To avoid falling into any such debt traps, use a credit card app that helps you manage your finances better. Linking your card to a mobile app allows you to easily check your transactions, bills, and available limits.

That’s one of the primary advantages of getting the One Credit Card. Its full-stack mobile app can be your perfect financial partner. The One Credit Card App allows you to analyse your account and set budgets as per the category. Also, you will be notified whenever you are closing in on your budget limit and payment due date. This allows you to spend confidently without any worries.

You can also discover great offline and online offers on the app. Apply now for this instant credit card and discover a world of benefits at your fingertips.